Oil Pushes Higher as China Data Beats and Russian Refineries Hit

(Bloomberg) -- Oil ticked higher following the biggest weekly advance in a month as macro-economic data from China came in ahead of expectations, and Ukrainian attacks on Russian refineries heightened geopolitical risks.

Global benchmark Brent rose toward $86 a barrel after gaining 4% last week, while West Texas Intermediate was above $81. China’s factory output and investment grew more strongly than expected at the start of the year, figures on Monday showed. The country is the world’s largest oil importer.

In Russia, meanwhile, drone strikes over the weekend hit multiple plants, some deep within the country’s territory. Diesel futures are higher for a third session. The attacks came as Vladimir Putin swept to victory in a presidential election.

Crude has broken out of a tight trading range that dominated the opening months of the year, with prices recently hitting the highest level since November. The advance has been underpinned by OPEC+ cutbacks to production, and predictions for a global deficit this year. Reflecting the shift in tone, banks including Morgan Stanley have been nudging their oil-price forecasts higher.

“The strikes on Russian refineries added $2 to $3 a barrel of risk premium for crude last week, which remains in place as we start this week with more attacks over the weekend,” said Vandana Hari, founder of Vanda Insights in Singapore. Still, with a US monetary policy decision due this week, “economic sentiment could return to the center stage for the oil complex.”

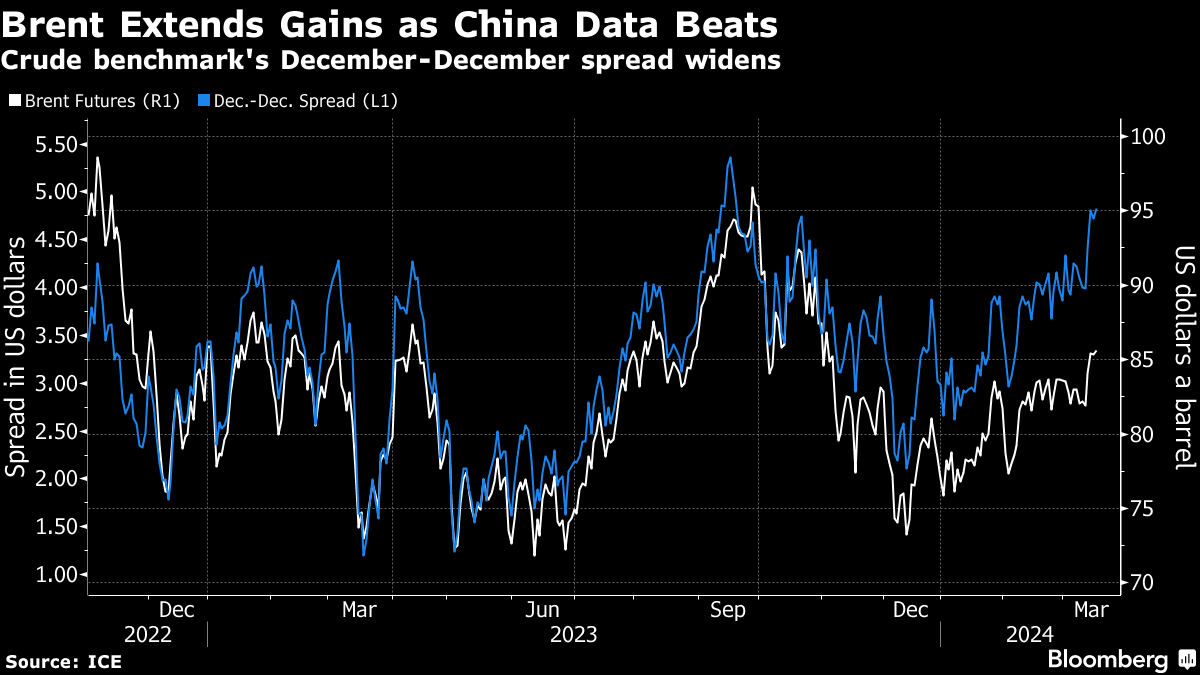

Oil’s timespreads suggest that conditions are tightening. The gap between Brent’s two nearest December contracts — the one for this year and its counterpart in 2025 — widened to $ a barrel in backwardation, a bullish pattern. That’s up from $2.66 at the start of the year.

Crude’s latest leg higher has been accompanied by a jump in the number of outstanding contracts, known as open interest. Holdings have surged to the highest since October 2021, with a gain seen toward the end of the last week.

In the coming days, traders will get a host of market insights from the CERAWeek conference in Houston, which starts on Monday. Among speakers scheduled on the opening day are the chief executive officers of Exxon Mobil Corp., Saudi Aramco, Shell Plc and TotalEnergies SE.

The US Treasury Department, meanwhile, sanctioned another tanker. This time, it was the Marshall Islands-flagged Lady Sofia, which the US says was involved in shipping Iranian commodities in support of the Yemen-based Houthi militants.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Holds Modest Loss as Risk-Off Tone Counters Lower Stockpiles

Apr 25, 2024

Oil Holds Gain With Stockpile Data and Iran Sanctions in Focus

Apr 24, 2024

Shell, TotalEnergies in Talks for Stakes in New Adnoc LNG Plant

Apr 23, 2024

Oil Steadies Above $87 as Traders Weigh Easing Middle East Risks

Apr 23, 2024

Rolls-Royce supplies mtu gas generator sets for remote Oman oil and gas production site

Apr 23, 2024

Dirtier and Heavier Oil Is Having Its Moment as Demand Shifts

Apr 22, 2024

Oil Falls After Weekly Losses as Traders Focus on Mideast Risk

Apr 22, 2024

Skittish Oil Market Enters an Uneasy Calm Over Middle East Risk

Apr 19, 2024

Exxon’s Market Value Tops Tesla’s as Oil Rises, EV Sales Slow

Apr 19, 2024

Oil Jumps Toward $90 After Israel Is Said to Strike Iran Targets

Apr 19, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum