Oil Declines as Industry Report Shows Bumper US Stockpile Build

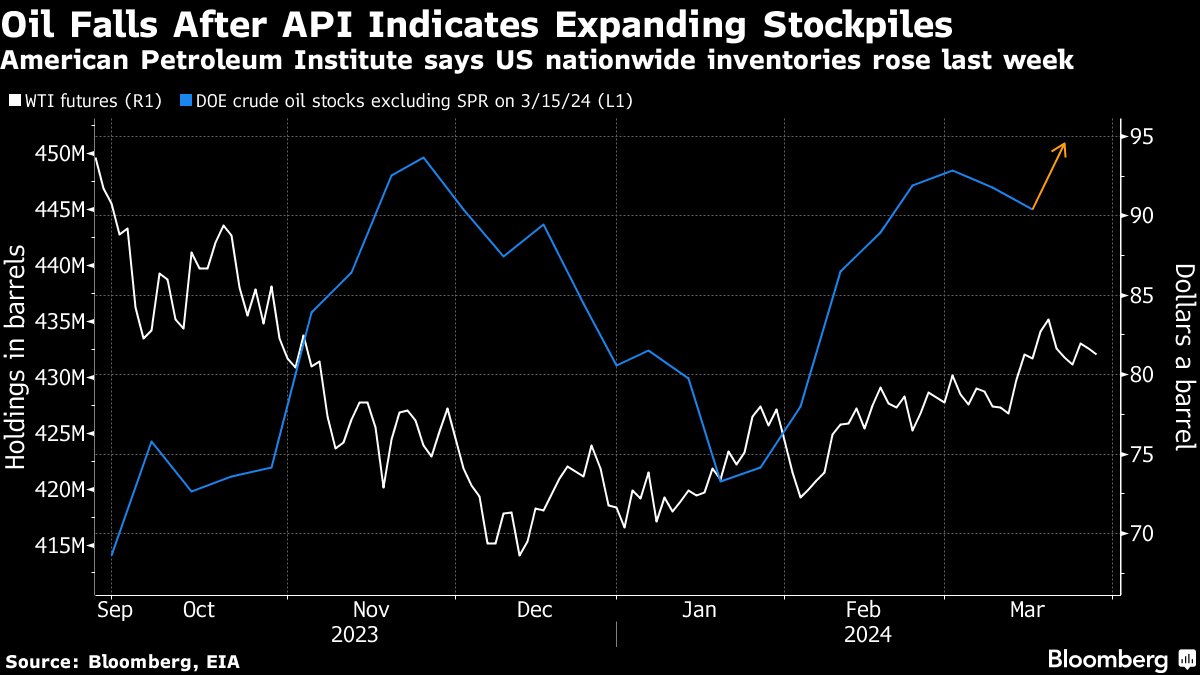

(Bloomberg) -- Oil extended a decline after an industry report pointed to a substantial build in US inventories, and wider markets struck a weaker tone ahead of the end of the quarter.

Brent fell toward $85 a barrel after a 0.6% drop on Tuesday, while West Texas Intermediate was below $81. The industry-funded American Petroleum Institute said nationwide stockpiles expanded 9.3 million barrels last week, according to people familiar with the data. The API also reported a 2.4 million barrel rise in crude at the Cushing, Oklahoma, hub, although gasoline stockpiles shrank.

If confirmed by government data due later Wednesday, levels of crude at Cushing would have posted the biggest weekly gain in barrel terms since January 2023. Meanwhile, gasoline inventories would have fallen for an eighth week, the longest run of declines in almost a year.

Broader financial markets were weaker, weighing on crude and other commodities such as copper. Equity markets in Asia were mixed after US benchmarks wiped out gains in the final half hour of trading as investors rebalanced their portfolios.

Oil has rallied this quarter after breaking out from a tight range that held for the year’s first couple of months. Geopolitical uncertainty amid Ukrainian drone attacks on Russian oil infrastructure and extended supply cutbacks by OPEC+ have buoyed prices, although a challenging economic outlook in China and robust non-OPEC supply growth remain headwinds.

“We should see a slightly tighter market in the second quarter, given OPEC+’s voluntary cuts are being extended,” and as demand picks up, said Sean Lim, an analyst for RHB Investment Bank Bhd in Kuala Lumpur. Still, prices “are getting less sensitive and responsive to any rolling over of voluntary cuts.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Steadies Above $87 as Traders Weigh Easing Middle East Risks

Apr 23, 2024

Rolls-Royce supplies mtu gas generator sets for remote Oman oil and gas production site

Apr 23, 2024

Dirtier and Heavier Oil Is Having Its Moment as Demand Shifts

Apr 22, 2024

Oil Falls After Weekly Losses as Traders Focus on Mideast Risk

Apr 22, 2024

Skittish Oil Market Enters an Uneasy Calm Over Middle East Risk

Apr 19, 2024

Exxon’s Market Value Tops Tesla’s as Oil Rises, EV Sales Slow

Apr 19, 2024

Oil Jumps Toward $90 After Israel Is Said to Strike Iran Targets

Apr 19, 2024

AD Ports Group signs deal with ADNOC Distribution for global distribution of marine lubricants

Apr 19, 2024

Europe Car Sales Drop in March as EV Weakness Persists

Apr 18, 2024

ADNOC to redeem exchangeable bonds in ADNOC Distribution upon maturity in June 2024

Apr 18, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum