Oil Steadies Above $87 as Traders Weigh Easing Middle East Risks

(Bloomberg) -- Oil steadied after a modest loss as traders weighed the next steps between Israel and Iran amid signs of easing hostilities following a tit-for-tat exchange of attacks last week.

Brent traded above $87 a barrel after slipping 0.3% on Monday, and West Texas Intermediate was near $82. Israel is returning to its goals of eliminating what it says is the last remaining stronghold of Hamas in Gaza and of freeing the remaining hostages, which will keep tensions elevated in the region.

“Crude has unwound the Israel-Iran risk premium but could slip into a holding pattern,” said Vandana Hari, founder of Vanda Insights in Singapore. “It’s hard to see a correction from current levels unless there’s a breakthrough on the Gaza front.”

Futures are coming off a back-to-back weekly loss, but remain higher this year due to geopolitical risks and OPEC+ supply cuts that have tightened the market. The US Congress has moved to further curb Iran’s oil sector, although analysts see a muted impact on exports.

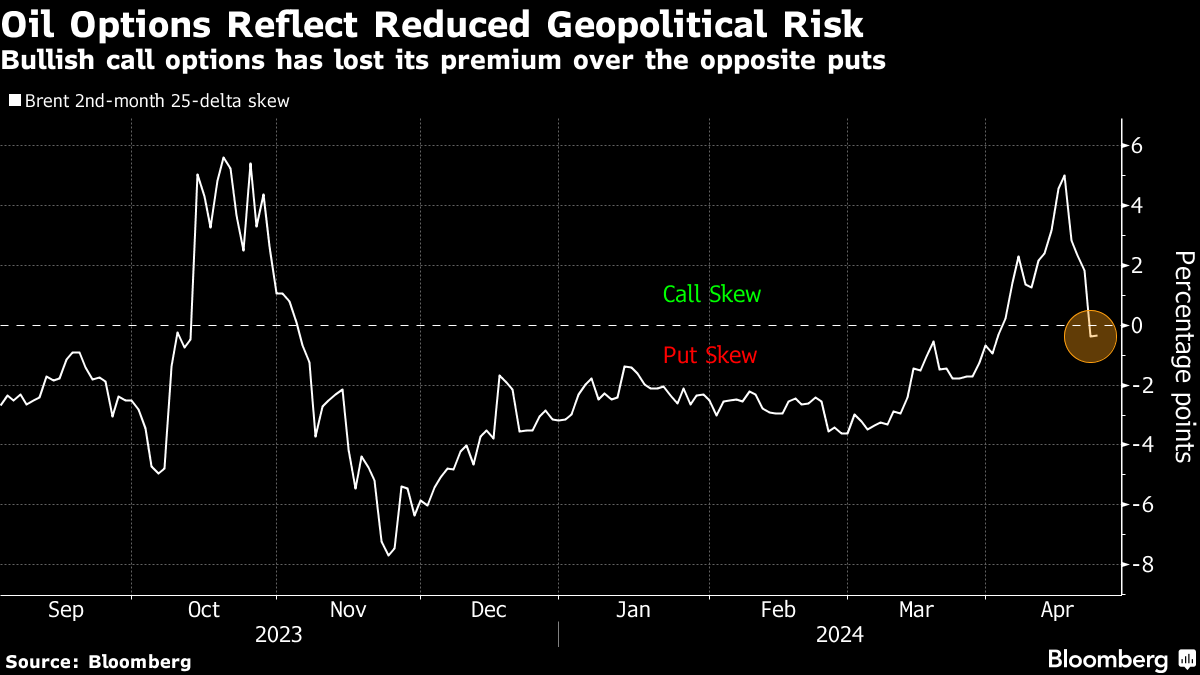

Easing tensions are being reflected in the options market, with bullish Brent calls — which profit when prices gain — losing its premium to the opposite puts. However, timespreads are still signaling strength, with the gap between the two nearest contracts for the global benchmark at 94 cents a barrel in backwardation, compared with 79 cents a week ago.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Drops as Progress on Cease-Fire in Gaza Shrinks Risk Premium

Apr 29, 2024

Red Sea Diversions Spew Carbon Emissions Equal to 9 Million Cars

Apr 29, 2024

Qatar Energy Minister: demand for oil and gas will continue for a long time and industry must act responsibly

Apr 29, 2024

Exxon and Chevron Output Booms in World’s Hottest Oil Patches

Apr 27, 2024

Pemex Ekes Out Tiny Profit as Oil Production Decline Resumes

Apr 26, 2024

Oil Heads for Weekly Advance Ahead of Critical US Inflation Data

Apr 26, 2024

Oil Holds Modest Loss as Risk-Off Tone Counters Lower Stockpiles

Apr 25, 2024

Oil Holds Gain With Stockpile Data and Iran Sanctions in Focus

Apr 24, 2024

Shell, TotalEnergies in Talks for Stakes in New Adnoc LNG Plant

Apr 23, 2024

Rolls-Royce supplies mtu gas generator sets for remote Oman oil and gas production site

Apr 23, 2024

Why the energy industry is on the cusp of disruptive reinvention

Mar 12, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum