Oil Edges Lower as Israel Weighs Up Response to Iranian Attack

(Bloomberg) -- Oil edged lower even as tensions in the Middle East persisted, with traders waiting to see how Israel would respond to Iran’s weekend attack.

Brent crude fell below $90 a barrel after ending little changed on Tuesday, while West Texas Intermediate was near $85. Israel has vowed to respond against Tehran for the unprecedented drone and missile attack, although the US and Europe have urged restraint.

Crude has surged this year as geopolitical risks in the Middle East and Russia, as well as OPEC+ output cuts, combined to push prices higher. Fresh comments on Tuesday from Federal Reserve Chair Jerome Powell, however, signaled that policymakers will wait longer than previously anticipated to cut US interest rates. That’s likely to be a headwind for wider energy demand.

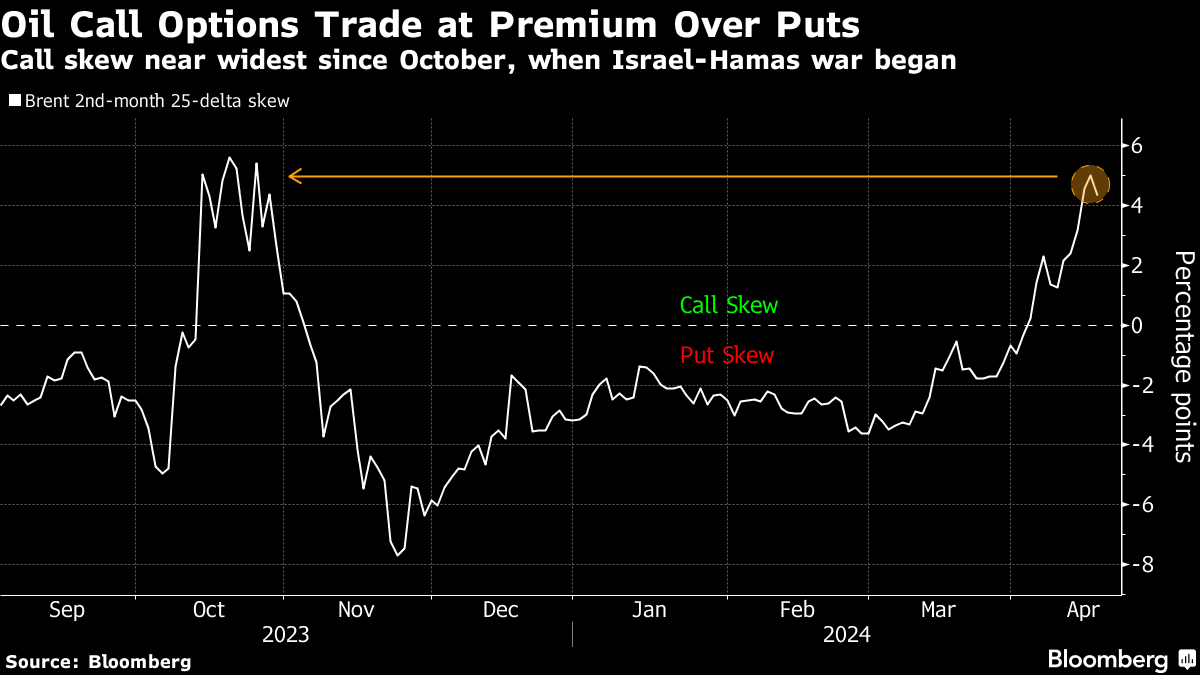

While headline price movements are muted, oil options markets are flashing warnings. Bullish call options are trading near the widest premium to opposing puts since October — when the Israel-Hamas war began — as trading volumes of calls soar. Traders piled into over 3 million barrels worth of options contracts in a bet that US oil would spike to $250 a barrel by June.

“Our base case is one where tensions remain contained, avoiding a wider conflict that disrupts oil supply,” said Han Zhong Liang, investment strategist at Standard Chartered Plc. Iran’s apparent restraint, with its statement that the matter was concluded, as well as diplomatic efforts between Israel and its allies may mean that “any such geopolitical risk premium is likely to be small,” Han added.

Stockpiles were also in focus after the American Petroleum Institute reported a rise of more than 4 million barrels in nationwide US inventories last week, although gasoline levels declined, according to people familiar with the figures. Official data are due later Wednesday.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Heads for Weekly Advance Ahead of Critical US Inflation Data

Apr 26, 2024

Oil Holds Modest Loss as Risk-Off Tone Counters Lower Stockpiles

Apr 25, 2024

Oil Holds Gain With Stockpile Data and Iran Sanctions in Focus

Apr 24, 2024

Shell, TotalEnergies in Talks for Stakes in New Adnoc LNG Plant

Apr 23, 2024

Oil Steadies Above $87 as Traders Weigh Easing Middle East Risks

Apr 23, 2024

Rolls-Royce supplies mtu gas generator sets for remote Oman oil and gas production site

Apr 23, 2024

Dirtier and Heavier Oil Is Having Its Moment as Demand Shifts

Apr 22, 2024

Oil Falls After Weekly Losses as Traders Focus on Mideast Risk

Apr 22, 2024

Skittish Oil Market Enters an Uneasy Calm Over Middle East Risk

Apr 19, 2024

Exxon’s Market Value Tops Tesla’s as Oil Rises, EV Sales Slow

Apr 19, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum