Halliburton Sees Best Profit in 12 Years Amid Smaller Shale

(Bloomberg) -- Halliburton Co., the world’s biggest provider of fracking work, posted its best earnings for a first quarter in a dozen years despite a shrinking business in the shale patch that it said isn’t likely to recover this year.

The company that dominates the North American oilfield services market expects the hunt for natural gas not to return until next year. The company forecast “flattish” sales growth in the US and Canada this year and low double-digit increase elsewhere in the world. Shares fell 0.7% at 10:28 a.m. in New York trading.

“While we expect an eventual recovery in natural gas activity driven by demand from LNG expansions, our 2024 plan does not anticipate this recovery,” Chief Executive Officer Jeff Miller told analysts and investors Tuesday on a conference call.

Drilling and fracking for the heating and power plant fuel will be “the next big leg of growth in North America” in 2025 and beyond, he said.

The oil-services giant reported better-than-expected quarterly earnings of $679 million, excluding certain items, it said Tuesday in a statement. International sales grew 12% while North America revenue fell 8% compared to a year earlier. The world’s biggest hired hands of the oilfield are in the midst of a multi-year pivot away from the once-booming shale patch in search of greater growth overseas.

“Our customers’ multi-year activity plans across markets and asset types confirms my confidence in the strength and duration of this upcycle,” Miller said in the statement. “Our international business delivered its 11th consecutive quarter of year-on-year growth.”

The company, which has seen three straight quarters of year-over-year sales declines in its US and Canada region, is expected by analysts to show a full-year revenue drop of 1.4% in North America, according to data compiled by Bloomberg. International sales are expected by analysts to climb 11.5% this year.

SLB, a larger rival which dominates international services work, reported similar results last week with a 13% jump in total revenues while its North American sales dropped 6% from the same period a year earlier. Baker Hughes Inc. will round out the Big 3 oilfield-service earnings when it posts results later today.

Halliburton, with its unrivaled footprint in all of the major shale basins, offers the closest proxy to US producer activity. After better-than-expected output in 2023, the US shale patch is now in the midst of slowing down amid dwindling inventory for top-tier drilling locations, weak natural gas prices and industry consolidation. Total North American producer spending is forecast to drop 1% this year, according to Barclays PLC.

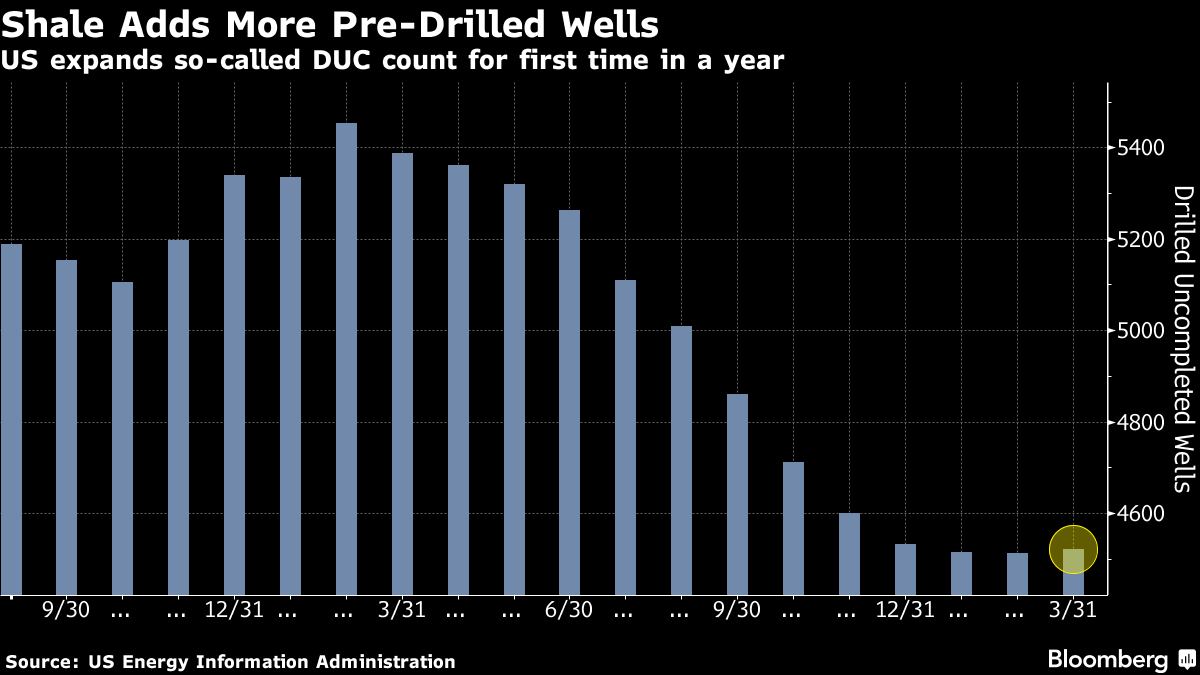

The closely watched tally of pre-drilled wells, known as the fracklog, reversed course last month, according to the US Energy Information Administration. The report indicated that the number of wells fracked grew slower than those drilled, offering another indication of a slowing hydraulic fracturing market.

(Updates with company guidance in second to fourth paragraphs)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Texas Power Prices Signal Grid Stress in Another Long, Hot Summer

Apr 27, 2024

Texas Natural Gas Prices Plummet After Pipeline Fire

Apr 26, 2024

Exxon Disappoints on Non-Cash Charges Despite Guyana Boost

Apr 26, 2024

EU Weighs Sanctions on Russian LNG Projects, Transshipments

Apr 25, 2024

European Gas Traders Are Already Worrying About Next Winter

Apr 24, 2024

TotalEnergies agrees to purchase the remaining 50% of Malaysian upstream operator SapuraOMV

Apr 23, 2024

Heat Pump Makers Woo Contractors in Effort to Spur US Sales

Apr 22, 2024

TotalEnergies launches Marsa LNG project and deploys multi-energy strategy in Oman

Apr 22, 2024

Mexico’s Sheinbaum Wants Debt-Laden Pemex to Go Green

Apr 20, 2024

Europe’s Top LNG Plant Operator Wants to Move Into Ammonia, CO2

Apr 19, 2024

Why the energy industry is on the cusp of disruptive reinvention

Mar 12, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum