Energy News

Gas & LNG

Southwest Gas Unit Gets $314.8 Million From IPO, Icahn Deal

Apr 17, 2024

Kazakhstan’s Compensation Claims Against Kashagan Oil Firms Jump to $150 billion

Apr 17, 2024

Oman LNG and Shell agree 10-year supply deal amid transition-led demand growth

Apr 17, 2024

Power Demand Surge Is Complicating Carbon Goals, Duke CEO Says

Apr 16, 2024

Equinor strengthens its gas position with a swap of onshore assets in the US

Apr 16, 2024

Tepco Flagship Nuclear Plant to Load First Fuel Since Fukushima

Apr 15, 2024

GE Vernova’s technology to help LG&E and KU further diversify sustainable energy portfolio

Apr 15, 2024

Biden Plans Sweeping Effort to Block Arctic Oil Drilling

Apr 12, 2024

LNG Importer New Fortress Energy Cuts London Trading Staff

Apr 11, 2024

Exxon CEO Pay Climbed 2.8% to $36.9 Million Last Year on Pension

Apr 11, 2024Oil

Oil Edges Lower as Israel Weighs Up Response to Iranian Attack

Apr 17, 2024

Oil Erases Gain as Traders Weigh Israeli Response to Iran Attack

Apr 16, 2024

Kent confirms enhanced project alliances with ExxonMobil and Repsol Norge

Apr 16, 2024

Mexico’s Sheinbaum Plans to Spend Billions on Gas, Solar Plants

Apr 15, 2024

What’s Next for Crude Oil? Analysts Weigh In After Iran’s Attack

Apr 15, 2024

Oil Traders Weigh Risks of Iran-Israel Conflict in Tight Market

Apr 14, 2024

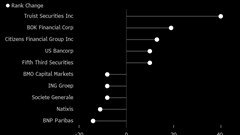

US Regional Banks Dramatically Step Up Loans to Oil and Gas

Apr 14, 2024

Oil Rises to October High as Israel Prepares for Iranian Attack

Apr 12, 2024

Gold Hits New Record, Oil Rises on Mideast Tension: Markets Wrap

Apr 12, 2024

Oil Swings Near $90 With Risk of Iran Strike on Israel in Focus

Apr 11, 2024Renewables

First Solar Jumps After Report Says Biden to End Trade Loophole

Apr 17, 2024

Biden’s Climate Law Catalyzed Investment, But Projects Still Face Snags

Apr 17, 2024

Masdar and EGA form alliance on aluminium decarbonisation and renewables

Apr 17, 2024

Chevron Launches $500 Million Fund to Invest in Clean Tech

Apr 16, 2024

Coal Keeps Powering India as Booming Economy Crushes Green Hopes

Apr 16, 2024

Eni company Plenitude commences construction of its largest ever solar project in Spain

Apr 16, 2024

How Amazon Became the Largest Private EV Charging Operator in the US

Apr 15, 2024

Equinor announces first battery storage projects in the United States

Apr 15, 2024

Japan’s largest power company JERA creates global renewables business headquartered in London

Apr 15, 2024

America’s Corn Belt Bristles at $8 Billion Lifeline

Apr 13, 2024Technology

SLB awarded three completion contracts for Petrobras’ offshore Buzios Field

Apr 15, 2024

ACME Group and Hydrogenious LOHC Technologies to jointly explore hydrogen value chains from Oman to Europe

Apr 10, 2024

TotalEnergies to ramp up battery storage capacity in Belgium with new project

Apr 03, 2024

Borouge commits to net zero in operations by 2045

Apr 02, 2024

SLB to acquire ChampionX in all-stock transaction worth $7.75 billion

Apr 02, 2024

Eni partners with Fincantieri and RINA for maritime transport decarbonisation mission

Apr 01, 2024

SLB announces agreement to acquire majority ownership in Aker Carbon Capture

Mar 28, 2024

GE Vernova debuts AI-powered emissions management software at Ivory Coast power plant

Mar 27, 2024

FRV and Harmony Energy announce Europe’s joint largest battery storage system by MWh

Mar 22, 2024

Toshiba generation equipment order will deliver improved power output in Kenya

Mar 20, 2024Utilities

IATA and partners reveal decarbonisation and net zero roadmaps for aviation industry

Apr 18, 2024

A Software Billionaire Is Betting Big on a Wild Climate Fix

Apr 17, 2024

European Gas Erases Year-to-Date Losses as Israel Vows Response

Apr 16, 2024

European Gas Steady as Traders See Muted Response to Iran Attack

Apr 15, 2024

Japan’s Top Power Producer Jera Considers IPO to Fund Green Push

Apr 15, 2024

MOL inaugurates central Europe’s largest green hydrogen plant

Apr 15, 2024

India Invokes Emergency Rules to Run Gas Power Plants for Summer

Apr 13, 2024

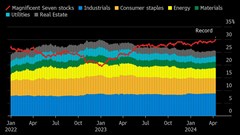

Magnificent Seven Influence Over S&P 500 Has Never Been Greater

Apr 12, 2024

China’s CGN New Energy’s Parent Said to Revive Take-Private Plan

Apr 11, 2024