Oil Posts Weekly Gain as Supply Outlook and Inflation Set Tone

(Bloomberg) -- Oil notched a weekly gain while futures stayed in a narrow range, with the outlook for supply and inflation in focus.

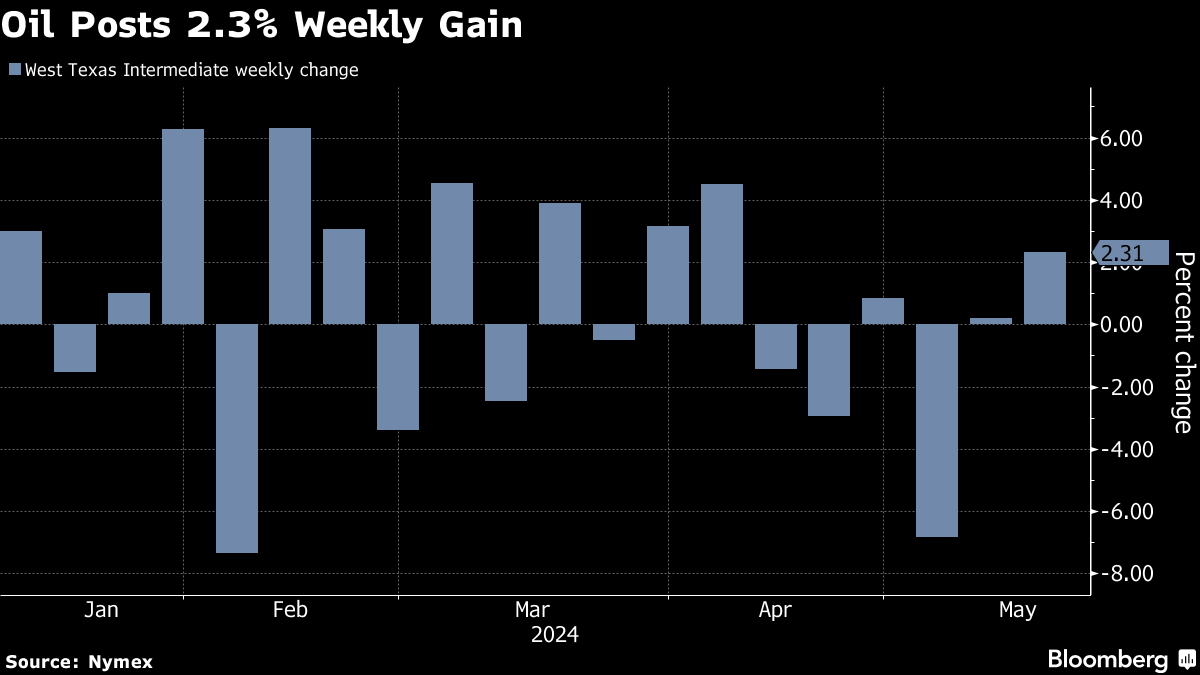

West Texas Intermediate settled above $80 a barrel, posting a 2.3% weekly gain and the third advance in four weeks. Lower US crude stockpiles and a sign that inflation could be ebbing have provided a lift to prices this week. However, they’ve had to vie in recent sessions with bearish forces such as an International Energy Agency outlook for weaker demand growth.

Although the market has shed much of its geopolitical risk premium over the past few weeks, traders got a strong reminder that threats remain after Ukrainian drones set Russia’s Tuapse refinery on fire. The facility has already been offline for three months this year following a previous strike.

Price action this week has been muted as the competing drivers largely offset each other. The conflicting factors resulted in a tight weekly range, with Brent volatility falling to the lowest since March. Traders are awaiting the next big catalyst in the oil market, and many expect to find it in the net OPEC+ meeting on June 1.

The group is widely expected to continue with existing production cuts, with some members seeking to have their capacity levels upgraded.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Eni named most-admired upstream explorer in Wood Mackenzie’s annual survey

May 30, 2024

China’s Oil Demand Outlook Darkens as OPEC+ Prepares to Meet

May 29, 2024

Hess shareholders approve $53 billion merger with Chevron, eyeing major Guyana oil assets

May 29, 2024

Oil Steadies as Geopolitical Tensions Rise Before OPEC+ Meeting

May 28, 2024

Oil Advances With OPEC+ Meeting and US Fuel Demand in Focus

May 27, 2024

China Defies Global Copper Squeeze With Near-Record Production

May 27, 2024

TotalEnergies greenlights second phase development for offshore Brazil project

May 27, 2024

ADNOC boosts local manufacturing target to $24.5 billion by 2030

May 27, 2024

Options Volatility Is Getting Crushed With Little Relief Ahead

May 26, 2024

BP Southern Africa, Shell Downstream to Sell Refinery Assets

May 25, 2024

Hydrogen and ammonia to play pivotal roles in the energy transition

May 21, 2024

Sarawak Energy aims to become the renewable powerhouse of ASEAN

May 20, 2024

LNG to play a key role as energy transition picks up pace

May 16, 2024

Expanding clean power infrastructure vital for a low-carbon future

May 15, 2024

Fuelling the Future: Boilermakers and the Hydrogen Revolution

May 14, 2024

More women in energy vital to the industry’s success

Mar 06, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum